Wow – that was fast! Spring 2022 has arrived. Although it still feels like winter, no doubt warmer weather is on its way.

Traditionally this is the time to get your vacuum and feather duster out to make your home sparkle. Cleaning your surroundings from top to bottom can be a fantastic mood booster. But what about using this opportunity to focus on your finances?

Spring cleaning your finances doesn’t need to be ground-breaking – it simply means applying a practical, common-sense approach to get your finances in better shape. The most challenging part, like with cleaning, will usually be to translate the desire to do this into sustained, measurable, action.

So, let’s get into five ways to spring clean your finances!

1. Track your spending

First, perhaps start by dividing all your spending into discretionary and non-discretionary spending (psst — sign up to our Six Weeks to Financial Fitness course to learn more about types of household spending!).

Non-discretionary spending is necessary to maintain the bare necessities of life – things that you need. This usually includes rent or mortgage repayments, utilities (power, water, telephone), food, clothing, cleaning, and maintenance.

Discretionary spending is generally non-essential and is often driven by desire, rather than need. These can include hobbies, travel, and entertainment.

Simple spring cleaning will see you shopping around for the best deals from energy and phone providers and reviewing whether there might be less expensive options. We are great at thinking it is too much bother to change service providers, and utility providers and banks love us for it by taking us for granted.

There are plenty of great websites, such as http://energymadeeasy.gov.au/ to check your energy plans. There are also websites to compare your mortgage, but make sure you understand the motivation of the websites providing these services as many appear to be for-profit companies. There is a federal government website that has some good tips about getting the best mortgage: https://moneysmart.gov.au/home-loans.

2. Review Credit Cards & BNPL services

We believe credit cards and Buy Now Pay Later (BNPL) services can have such an adverse impact that they deserve their own category.

The bottom line is that credit card and BNPL debit is some of the most expensive debt around (the average interest rate payable is 19.94% according to Finty), and we believe it should be handled with great care, and avoided completely if at all possible.

Credit cards can be ok (and you can use them to earn loyalty points which can be quite valuable), but only if you use them properly – by paying off the required balance in full at the end of each cycle.

Making only the minimum payment on the average credit card debt currently of $2,938 (based on Finder’s research) it will take you 33 years and 2 months to pay the balance off in full.

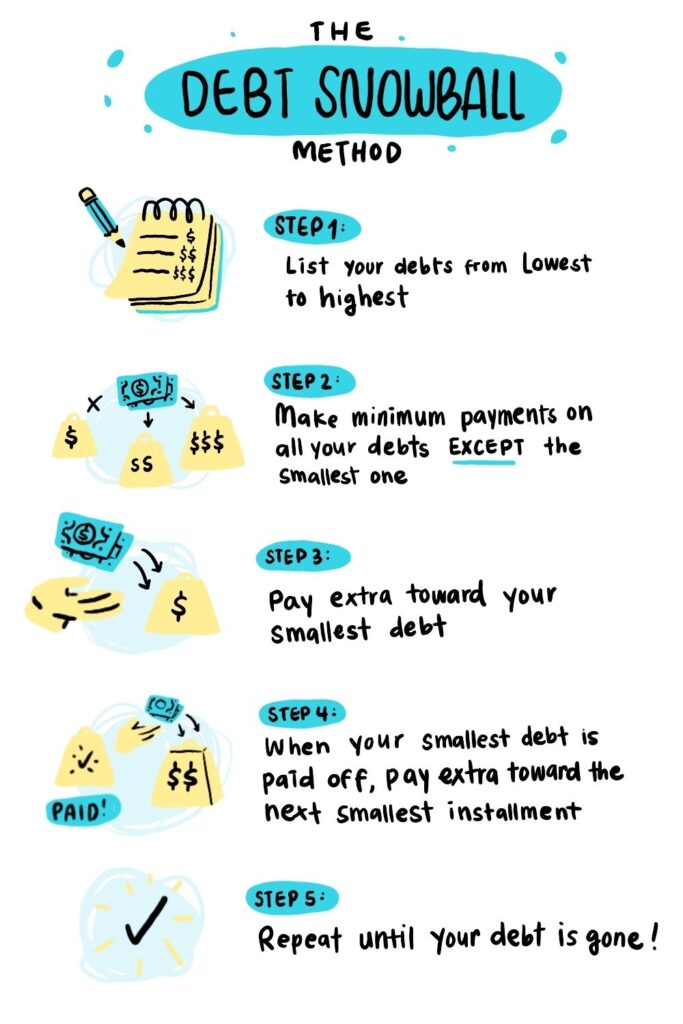

If you are repaying debt from credit cards or outstanding BNPL bills, do yourself a huge favour and make it an absolute priority to pay them all off as soon as you can. It’s easy to feel overwhelmed if you have several outstanding loans owing at once, so try tackling the smallest debt amount and work your way up after each one is paid off. This is known as the Snowball Method.

And – then work on not falling into the same trap as you were with credit card and BNPL debt.

Source: Buzzfeed | Debt Snowball Method

3. Prepare and stick to a budget

Now it is time to embrace the spreadsheet, and use it to track all your spending and income. This is only effective if you do two things, firstly, set it up, and then track whether you can keep to it. Monitoring this monthly is generally a good place to start.

If your income for the period is greater than your expenses, then congratulations, you’re in a cash positive position.

If the reverse is true, you need to turn that around. Otherwise, it will be very hard to ever get ahead.

Regardless of what position you are in, it is highly likely you can do better, either by increasing your income, or reducing your spending, or both. You just might need to work harder if you are currently in a negative cash position.

Handy hint: checkout MoneySmart’s Budget Planner if you’re creating a budget for the first time.

4. Education – not just yourself but involve your children as well

Educating yourself and your children is something that can be done at any time and quite cheaply too. For example, do you shop at Woolworths, Coles, IGA, maybe ALDI? What do you know about them from the news? Does your shopping experience reflect what you read or hear? What type of business decisions do you think they have to make, and why? If you take your children shopping with you ask them why the price of vegetables might be higher now.

Or learn to read company reports by completing free courses by the Australian Securities Exchange. Read the finance section in daily newspapers and watch the finance news on television. Look out in your daily life to see if you can recognise the companies mentioned. Read whatever you can, and then try and apply what you have are learning to your own situation and understanding of the companies you are interested in.

Education is a slow burn. You may find it difficult to see the cause and effect for a while, but if you keep at it, it will begin to make sense.

5. Start Investing

The large number of investing options can be a huge hurdle to first time investors. It is easy to feel intimidated by the information available and believe you have no place participating.

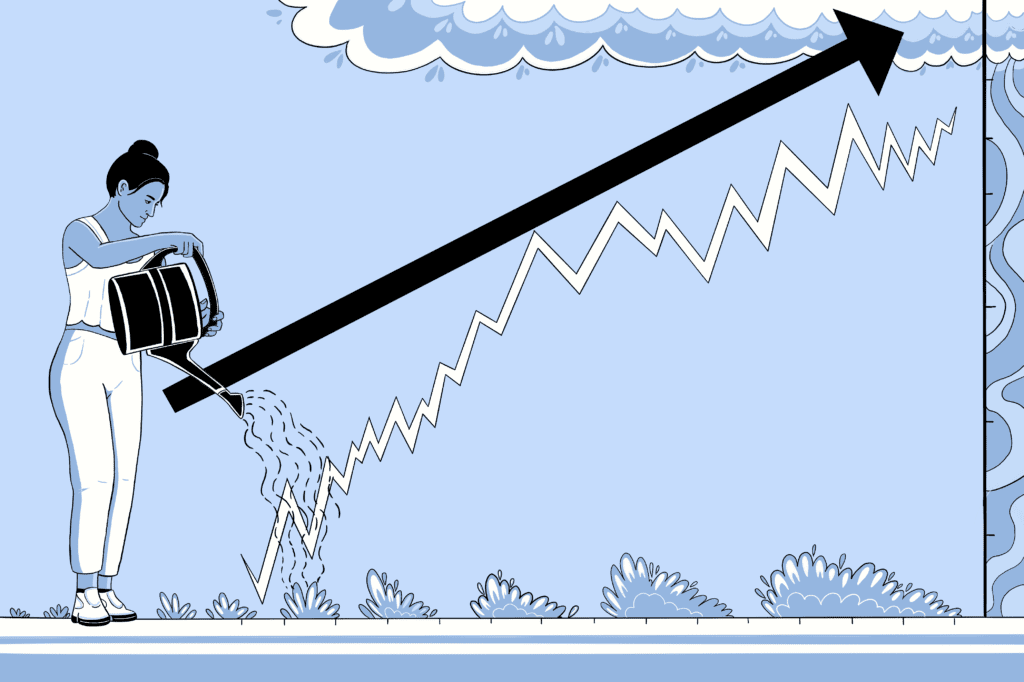

The good thing is that the patient, committed, medium to long term investor is usually rewarded. The equity market shows it consistently outperforms any other asset classes (i.e., cash or bonds) over time, so keep this in mind!

And there is no time like the present to get started. Don’t put off starting because you think the time isn’t right – you will be waiting a while. A good rule of thumb is if you can invest on a regular basis, then over the long term any market fluctuations will average out your returns.

Once you start it will feel great that you are doing something worthwhile for you and your family.

If you’re prepared to take this first step then you might like to consider joining the Itrust Invest community where you can regularly invest from as little as $10.

Source: Investopedia | How To Invest In Stocks

Wrapping up …

So there we have it – five ways to spring clean your finances. Each of them pretty simple and straightforward, but more difficult in execution. The important thing is to get into the habit of performing these acts, so they become ingrained and second nature. Stay focussed, stay committed, and keep learning!

When it comes to investing the sooner you start, the more time compounding growth has to work it’s magic. Consider joining the Itrust Invest community today and start to make a real difference to the future of your loved ones.

If you’d like to know more then speak to the team via the live chat below, or give us a call on 1300 811 119 – we’d love to hear from you.

Copyright © Itrust Invest 2022

Disclaimer: in preparing this blog we have not considered your personal investment objectives, financial situation or needs. Instead, this blog contains general advice and has been prepared for informational purposes only. It is not intended as financial product advice or a recommendation in relation to any investments or securities. Terms apply when using the platform provided by Itrust Investment Fund, and it is important you read the PDS and key documents before deciding if any of our offerings are right for you.