It doesn’t cost much for parents to combat future financial pressures. In fact, teaching your kids healthy financial habits from an early age can do wonders for their development, and may help ease the burden on the Bank of Mum and Dad when they grow up.

Without further ado, here are our top tips for parents to support their little ones in an increasingly expensive world!

1. Be a good financial role model

Children are influenced by what they see their parents do and what they say. This means developing your own sound financial habits is possibly one of the most important things you can do for your children.

Show them the importance of spending wisely; explain the difference between discretionary and non-discretionary spending (P.S. sign up to our Six Weeks to Financial Fitness course to learn more about types of household spending).

Explain to them the household budget, going to the extent of detailing the regular mortgage or rental payments, food, utility and phone bills when they’re old enough to understand. Help them understand why you limit the number of times you go out to a restaurant each month or that you’re not going to subscribe to the latest streaming service because you know you have to meet your rental or mortgage payment.

Show them what this sacrifice can mean in the long term – set up a regular savings process so you can prove that even putting a little away on a regular basis can add up to more than you might think over time. Try and explain to them the rationale behind each large, and small, spending decision in your home.

The take-away message is only after you have dealt with the essential costs can you think about some fewer essential items, or better yet, put some of that balance into savings.

2. Teach them healthy financial habits

Having sound financial habits means being in control of your cash flow and that your spending does not exceed your income. An easy way to ensure spending doesn’t exceed your income is not to use credit – after all you can’t spend what you don’t have access to, right?

Once spending is under control, you can then talk about saving. Saving even a little each period is valuable. It can allow good habits to be learned and entrenched, and it can add up over time. Learn to appreciate that warm fuzzy feeling when lifting a heavy piggy bank, or watching numbers in a saving or investing account increase over time.

With saving can come conversations, and possibly practical application, about investing. Discussions about companies can come reasonably early. Discuss who owns the particular grocery store at which you shop. Talk about the companies mentioned on the news or in the newspaper. How are they run? Who owns them? How do they make money? Who is the beneficiary of the money that is made? When you pull out your smart phone and use an app, explain the companies behind both the phone and the app, and their stories if you know. How did they come about, and whether you can invest in them, and the reason why you would.

Open an Itrust Invest account and ease the dependence on the Bank of Mum and Dad as your kids grow up.

Encourage them to get a part time job and to save

A part time job may help your children understand the link between effort and reward. It may also help them develop the discipline of able to be relied upon to complete a particular task, as well as helping them become more resilient. If they don’t like the job, help them understand how to get a better one – one path might be becoming better educated.

Encourage them to save what they have earned, rather than spend it immediately. Have them set a savings goal if they want to buy something special. Research says we enjoy and appreciate something more if we have to wait for it. This will hopefully develop a healthier approach to spending and greater appreciation for and satisfaction with what they do buy. Research has also shown that learning to delay reward is a trait of highly successful people.

If your child can learn to delay the desire for instant gratification, this will lower the likelihood of them spending unnecessarily and misusing credit cards and BNPL services. This will then lower the likelihood their credit rating will be adversely impacted, and so increase their overall chances of developing a healthy attitude towards finance.

Maintain the highest credit rating possible

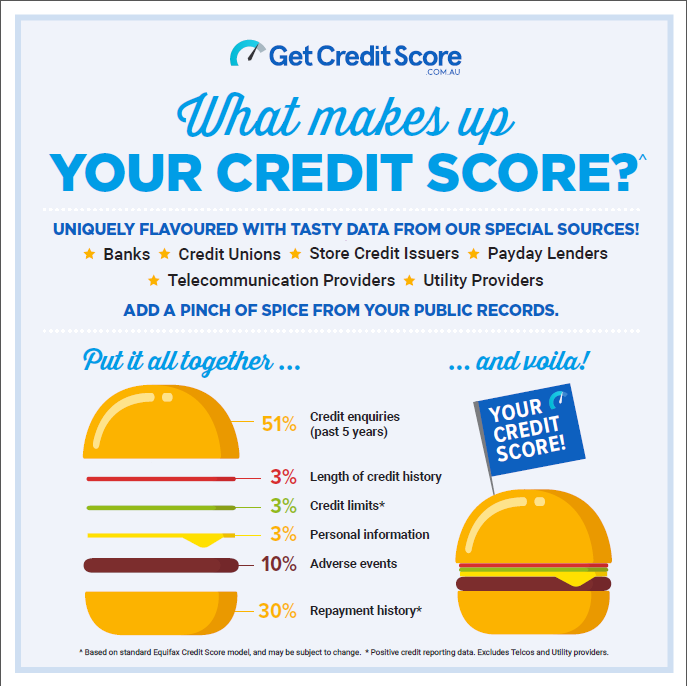

If a long-term goal is for your children to own a home it is imperative they have a good credit rating. A credit rating is used by banks to assess the level of risk of a borrower. The better the credit rating, the more a bank is willing to lend.

Even if a bank is willing to lend they may only lend at a higher interest rate to someone who has a poor credit rating.

What adversely impacts a credit rating can be being late to or failing to pay a credit card payment, phone or utility bill. The number and credit limit of credit cards someone has will also be a factor – the more credit cards and the higher credit limits will mean a bank will lower the amount they are willing to lend, if at all. The same goes for BNPL services. However, a good history with a credit card can help establish a pattern of responsible borrowing and repayment.

A lower mortgage interest rate means less financial pressure, a greater ability to repay the mortgage principal faster and to absorb any interest rate rises, and less stress overall.

Source: GetCreditScore.com.au

Even though the dream of getting a home may seem like a long way off, poor financial decisions at a young age may come back to bite, and it is always a good idea to get into good habits early.

Encourage children to become as highly educated as possible

This is all about increasing options for your children. This does not necessarily mean everyone should go to university, but there is some correlation between level of education and earning power. That said, academic learning may not suit everyone and there are certain trade occupations and opportunities whose salaries would put a white-collar employee to shame.

The point about education is ideally to develop an appreciation for learning and a curious mind. A curious mind and an ability to learn will allow your children to seek out opportunities for themselves and learn new concepts easily and quickly.

And when it comes to investing the sooner you start, the more time compounding growth has to work it’s magic. Consider joining the Itrust Invest community today and start to make a real difference to the future of your loved ones.

If you’d like to know more then speak to the team via the live chat below, or give us a call on 1300 811 119 – we’d love to hear from you.

Copyright © Itrust Invest 2022

Disclaimer: in preparing this blog we have not considered your personal investment objectives, financial situation or needs. Instead, this blog contains general advice and has been prepared for informational purposes only. It is not intended as financial product advice or a recommendation in relation to any investments or securities. Terms apply when using the platform provided by Itrust Investment Fund, and it is important you read the PDS and key documents before deciding if any of our offerings are right for you.