Opening an Investment Account For Kids

Traditionally, a bank account has been a popular way for parents to save for their children’s future weddings, university fees or that all important first house deposit, but with inflation expected to hit record highs this March 2022 quarter it’s crucial to take note of the interest earned through a savings account.

The last thing you want is for inflation to eat away at the purchasing power of your hard-earned savings!

Instead, opening a kids investment account with a long-term focus is a great solution for parents looking to give their little one’s a financial leg up in life.

In this article, you’ll find a list of things to consider when deciding to invest on behalf of your children, and we’ll also flag important factors to consider when deciding which investment platform to choose.

Benefits of investing vs saving cash

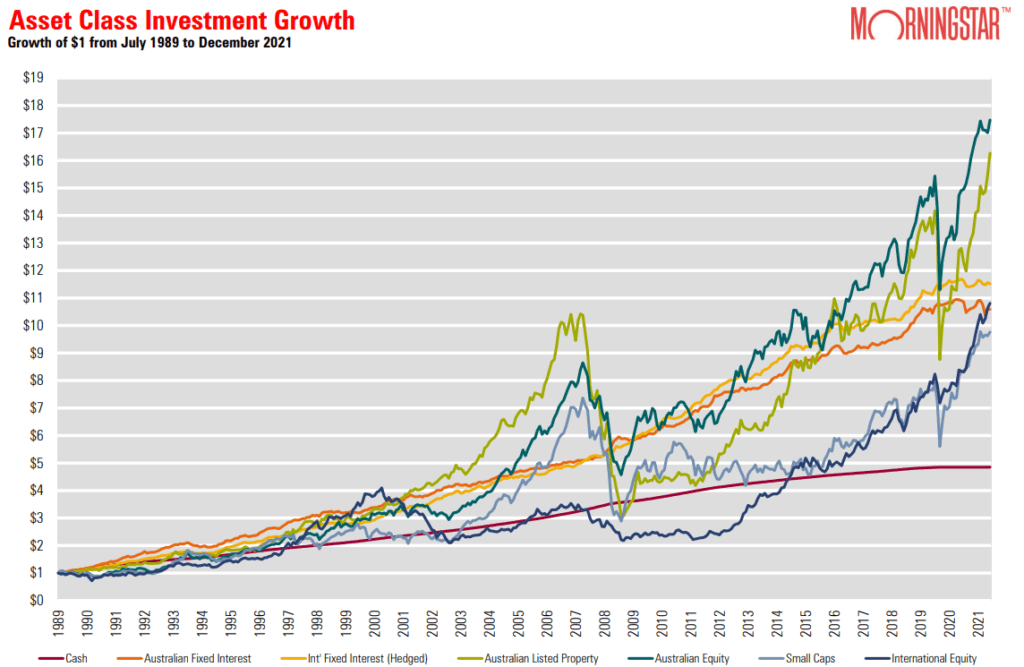

The overall reason for investing your money versus placing it in a savings account is the greater expected return. Over the medium to long term, returns from equities have outperformed returns from savings in a bank account (hint: note how cash has historically delivered the lowest returns in the chart below).

Source: Morningstar, Growth of $1 from July 1989 to December 2021

However, despite the low return, a bank account is very safe, with the Australian Government guaranteeing your savings up to $250,000.

If you’re just starting out, perhaps it is a good idea to dip your toe in the water and open an investment account managed by professional fund managers. This can help take the stress away from deciding which individual companies you should invest in, and enables first time investors to diversify a smaller portfolio which may spread their investment risk.

Investing for the long-term vs saving for a short-term goal

Over the medium to long term, returns from investing in shares are expected to be greater than simply placing your money in a savings account at a bank.

However, this does not mean that investing is suitable for every circumstance or goal. A good question to ask yourself is how you might feel if that money you were saving suddenly declined in value or disappeared altogether.

For example, if you are saving up to buy your child a top of the range mountain bike for their birthday, it is probably better to accumulate your savings in a bank account. That way you can be certain that the balance when you need to withdraw it will not have declined in value.

Essentially, any time you have a short-term savings goal, or want a healthy deposit on hand for emergencies, it may be wiser to use a bank account rather than investing it.

Things to consider when choosing an investment platform

The rise of low cost, easy to use micro-investing apps and platforms has seen almost 1.8 Million Aussies start their investing journeys. Suffice to say, getting started has never been easier. With so much choice however, here are some of the things you might want to think about when deciding which one to use.

Ease of set up

Securing your account is very important, but do you have to go into a branch with birth certificates and passports, or can you set up your account completely online, quickly, and easily?

Minimum investment amount

Traditionally, to buy stocks listed on the Australian Securities Exchange you must invest at least $500. If this is too great a hurdle for you, there are some great platforms that allow you to invest with as little as $10. Some also allow you to make regular, automatic, contributions, so once you’ve set yourself up, you don’t need to think about it again.

Creating additional accounts for growing families

Some platforms let you have multiple sub-accounts. While the parent or guardian remains the legal account owner, you can still allocate funds to these separate sub-accounts, which might be set up with your children named as beneficiaries. A good thing to check is whether the investment platform allows you additional sub-accounts to be created at no extra cost, which is important for growing families or guardians wanting to incorporate nieces and nephews down the track.

Fees

Fees are important to understand. Fund managers are required to be careful and transparent in disclosing what fees they charge their customers, so if this is hard information to find then proceed with caution. Most managed investment platforms charge the following types of fees.

Account maintenance fee – a regular fee for providing and managing the platform. This might be taken straight from your credit or debit card and is a fee you can directly identify.

Funds management fees – these are levied at the fund level. You aren’t directly charged for these fees, rather they impact the unit prices of the fund. These fees are usually expressed as a percentage of the value of the fund, i.e., 0.30% of funds under management. This is the income of the fund manager. You won’t be directly charged this fee.

Entry and exit, or withdrawal, fees – known as the “spread”, the unit price you pay when you buy units in the fund will be higher than the unit price you sell your units at. Some fund managers take this difference as income. You won’t be directly charged these fees.

Fund and management expenses – used to cover the expenses of operating the fund, such as legal, regulatory, and accounting expenses. These are usually expressed as a percentage of the value of the fund, i.e., 0.40% of funds under management. You won’t be directly charged this fee.

Should you open an investment account for your kids?

Opening an investment account for kids is a great way to unlock returns from compound growth and teach your children discipline and patience, but it is not suitable for every goal or circumstance.

If you’re thinking of opening an investment account for your kids, there are a few things to consider first, like fees and the ease of setting up, to ensure you are kicking your investing journey off on the right foot. But with so many great platforms available, it’s never been easier for parents to get started.

Itrust Invest can help make the process a whole lot simpler thanks to low fees and a $10 minimum investment.

If you’d like to know more then speak to the team via the live chat below, give us a call on 1300 811 119 or email us at support@itrustinvest.com – we’d love to hear from you.

Copyright © Itrust Invest 2022

Disclaimer: in preparing this blog we have not considered your personal investment objectives, financial situation or needs. Instead, this blog contains general advice and has been prepared for informational purposes only. It is not intended as financial product advice or a recommendation in relation to any investments or securities. Terms apply when using the platform provided by Itrust Investment Fund, and it is important you read the PDS and key documents before deciding if any of our offerings are right for you.