When it comes to investing for your children’s future, there is no better time to start than now. Also, by investing over a long term, your investment can grow exponentially thanks to the power of compound interest – i.e., earnings on earnings. An Itrust Invest account is a simple, low-cost way to unlock the power of compound growth, and in this blog we discuss the benefits of why parents should consider investing for their kids today.

How Compound Interest Works In Practice

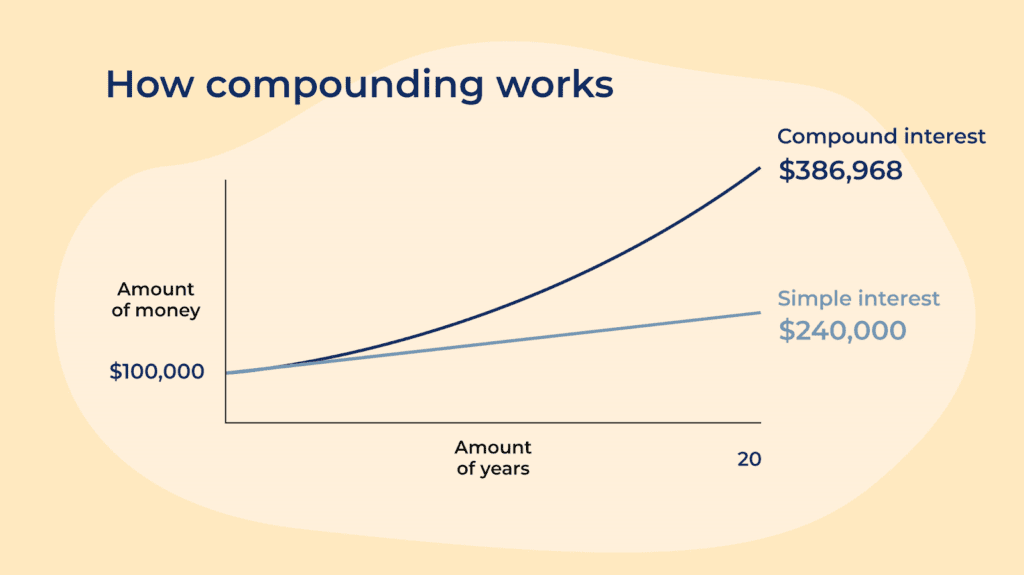

Compound growth in the form of compound interest, is often called a “miracle” because it has the power to turn a small investment into a large sum of money over time. With compounding, your earnings are reinvested back into your account, allowing it to grow at an accelerated rate through earnings on earnings.

To give you an example of how this works in practice, let’s say you invest $1,000 with a compound growth rate/interest rate of five percent per annum. At the end of the first year your account balance is $1,050, including $50 interest earned. At the end of the second year your account balance is $1,103 . This process continues so that by year 10, your account balance is $1,630 – a 63% growth on your original investment!

Of the $630 uplift on the original investment, $500 is in the form of simple interest (i.e.,10 years at 5% interest) and $130 is interest on interest – or earnings on earnings.

While this example may seem simplistic, it illustrates the power of compounding, and it’s one of the primary reasons why parents should start investing for their kids as early as possible. The sooner you start saving, the more time your capital has to compound and grow through earnings on earnings.

Source: Syfe | How Compounding Can Make You Rich

Investment Returns Historically Trend Positive Over The Long Term

While it’s true that stocks can have their bad days, even their bad years, history shows that share markets tend to rise over time.

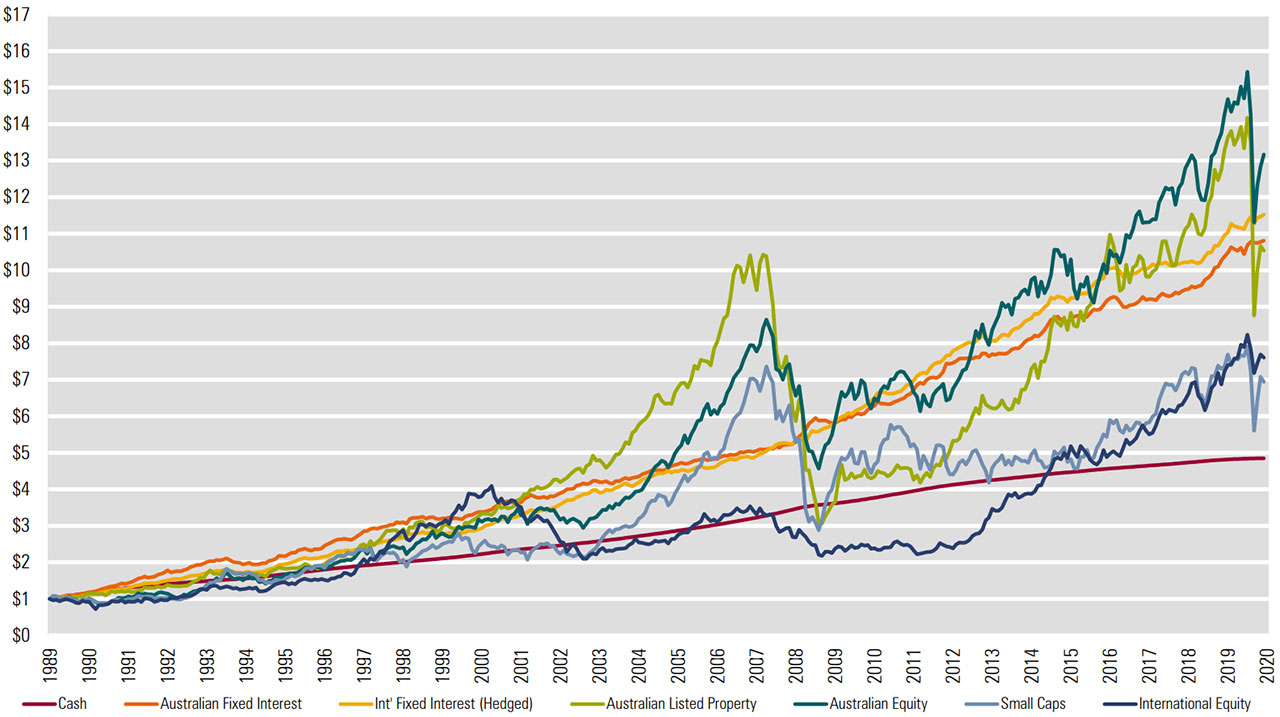

This is best shown in the chart below, which plots the long term returns of various asset classes such as; cash, Australian stocks, global stocks and international and domestic property.

The chart shows that various investment asset classes such as Australian equities (dark green line) and Global Equities (dark blue line) showed a positive compound annual investment return over 5,10,15 and 20-year periods AND outperformed the returns from cash (maroon line).

Growth of $1 from July 1989 to June 2020

Source: Review of Long-Term Asset Class Returns compiled by Morningstar, updated to 30th April 2022

In our view, the long-term investment horizon of a child’s account supports a bias towards growth assets (e.g., Australian and Global Equities) over income assets (e.g., Fixed Interest, Cash).

All things being equal, a child’s natural long term investment horizon grants the ability of their share portfolio to recover from any poor short-term performance.

At Itrust Invest we currently offer three investment options – Global Equities (100% growth), Balanced Fund (50% growth and 50% income) and Gold. Investors decide their allocation to each investment option and can change their allocation at any time.

Compound Interest: Friend or Foe?

Albert Einstein considers compound growth in the form of compound interest as the 8th wonder of the world and is famously quoted as saying “he who understands it, earns it; he who doesn’t, pays it”. Don’t get this confused however, as simply understanding compound interest won’t magically make you rich. What Einstein means is that compound interest is a two-way street – it works to enhance the money you put away in savings, but it can also work against you when you are the one paying it, such as with outstanding debt. Credit card debt for example is often compounded daily, so the longer you have an outstanding balance, the more the interest that is added on top of it grows and hence the larger your balance grows.

To wrap up

By starting early and investing regularly, even small monthly contributions can grow into a sizable nest egg over time. As a parent, it is important to be aware of the power of compound interest and how it can impact your family’s financial future.

If you’re not sure where to start, a financial advisor can help you find the best investment options for your needs and goals. They can also provide guidance on how much you should be saving each month to reach your desired goal, and the steps you should be taking to help reach your goals.

When it comes to investing the sooner you start, the more time compounding growth has to work it’s magic. Consider joining the Itrust Invest community today and start to make a real difference to the future of your loved ones.

If you’d like to know more then speak to the team via the live chat below, call us on 1300 811 119 or send an email to support@itrustinvest.com – we’d love to hear from you.

Copyright © Itrust Invest 2022

Disclaimer: in preparing this blog we have not considered your personal investment objectives, financial situation or needs. Instead, this blog contains general advice and has been prepared for informational purposes only. It is not intended as financial product advice or a recommendation in relation to any investments or securities. Terms apply when using the platform provided by Itrust Investment Fund, and it is important you read the PDS and key documents before deciding if any of our offerings are right for you.