Many parents would agree that food, shelter, and safety form the most basic physiological needs demanded by their children.

But for those families eager to give their little one’s a financial booster in life, we are witnessing an increase in parents using stock market investing to amplify their savings.

Now, by themselves children under the age of 18 cannot buy shares in their own name. But 2021 research by Finder.com.au suggests a growing number of parents and relatives are opening investment accounts and naming children as the beneficiary – with nearly 300,000 Australian kids accessing the share market this way.

Children of millennial parents are also more likely to have an investment account in their name, the study shows.

Source: Investing for children delivers them a world of opportunity – The Australian

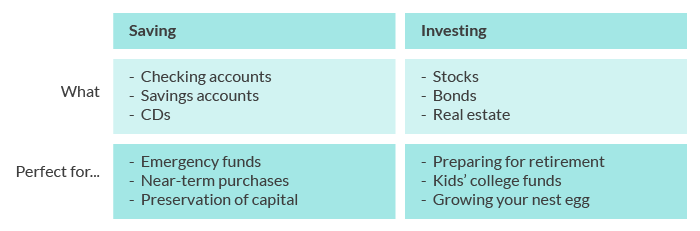

We believe there are two main reasons for this surge in parents using the stock market on behalf of their kids;

– Savings account just don’t keep pace with inflation over the longer term

– Stock markets generally offer higher returns and better suit long term goals

Let’s look at these two points in closer detail.

High inflation may erode your savings over time

To protect the purchasing power of their hard-earned savings, parents are investing their money in the stock market to ensure that savings meant for their kids in 10- or 20-years’ time keeps pace with inflation.

Recent data showed the consumer price index (aka inflation indicator) rise to 6.1% from June 2021 to June 2022. This means $1000 a year ago would now be able to buy you $939 worth of goods. In essence, your purchasing power has diminished.

Source: Investopedia

Ultimately, it’s the parent’s choice whether they choose to invest or not, but with current inflationary pressures it’s important to take notice of the interest earned on your savings account.

Bank accounts – even youth savers accounts – are lucky to return anything over 3.5-4 per cent interest p.a. currently. And if they do there are usually certain conditions and requirements.

Just to be clear, some inflation is a good thing – it shows the economy is growing.

A growing economy should translate to higher profits for companies and then flow through to higher wages for employees. This is a primary reason why the Reserve Bank of Australia has a target inflation rate of 2–3 per cent, on average, over time.

It’s when inflation is high, and especially when it outpaces wage growth, that standards of living can be impacted.

Equity markets offer better returns over the long term

While it’s true that stocks can have their bad days, even their bad years, history shows that share markets tend to rise over time. And if it’s one thing that children have in spades it’s more time.

All things being equal, a child’s natural long term investment horizon grants the ability of their share portfolio to recover from any poor short-term performance.

This, makes investing in the stock market better suited to parents who have the longer goal of saving for their children’s collage fund or help with a first house deposit.

Source: M1 Investing

But don’t just take my word for it. Let’s look at the facts:

- $10,000 investment into a basket of the largest two Australian companies in June 2002 will have grown to $68,564 by the time your new-born is 20 years old

- $10,000 deposited into a savings account over the same period of time will only grow to $20,286*

Not accounting for fees or taxes, investors would enjoy a premium of $48,000 by putting their money into the Aussie equity market compared to a bank account.

While loss of capital is always a risk of investing, many experts argue that not investing is the greatest risk of all. This phenomenon is referred to as opportunity cost and describes the amount of money you might miss out on by going with one option instead of another. In our case, it’s parent’s choosing to save cash versus investing in the stock market.

Our tips for parents using the stock market to get ahead:

- When it comes to investing, slow and steady usually wins the race. Consider this scenario; by depositing $10,000 into an investment fund paying 10% interest per annum, and committing to monthly contributions of $100, then over a period of 40 years you will have saved $1 Million dollars for your kids.

- Lean on family and friends for help. Families who invest the money that children receive for Birthdays and Christmas can help turn small sums into large balances over time thanks to the power of compounding

- Be as transparent and include your kids in the process. Children are mostly visual learners, and by showing them what you’re invested in as well as the changing value each month they can better understand how share markets work

- Open a real investment account and start small. Some micro-investing platforms let you invest from as little as $10

- Take the time to understand the relationship between risk and return. Generally, cash and bonds will offer lower risk and less volatility, but at a lower return. Stocks, especially international stocks, can be very volatile but historically produce higher returns over the longer term

Key Takeaways

As a parent and an investor, it is important to keep in mind the end goal – are you trying to save for your child’s future wedding, University fees or help towards their first house deposit?

If you’re not sure where to start, a financial advisor can help you find the best investment options for your needs and goals. They can also provide guidance on how much you should be saving each month to reach your desired goal, and the steps you should be taking to help reach your goals.

When it comes to investing the sooner you start, the more time compounding growth has to work it’s magic. Consider joining the Itrust Invest community today and start to make a real difference to the future of your loved ones.

If you’d like to know more then speak to the team via the live chat below, or give us a call on 1300 811 119 – we’d love to hear from you.

Copyright © Itrust Invest 2022

Disclaimer: in preparing this blog we have not considered your personal investment objectives, financial situation or needs. Instead, this blog contains general advice and has been prepared for informational purposes only. It is not intended as financial product advice or a recommendation in relation to any investments or securities. Terms apply when using the platform provided by Itrust Investment Fund, and it is important you read the PDS and key documents before deciding if any of our offerings are right for you.

*Australian Equity returns according to ASX:XJOAI, and savings returns according to the Bloomberg AusBond Bank Bill Index 20-year returns