A lot of people have done very well investing in companies on the Australian Securities Exchange (ASX), and a growing number of parents these days are considering opening a kids investment account to expose their children to the growth of the Australian share market from a young age.

However, there are valid reasons why it pays to look beyond our shores for investing opportunities. To put things into perspective, consider this;

- Australia comprises approximately 0.3% of the world’s population

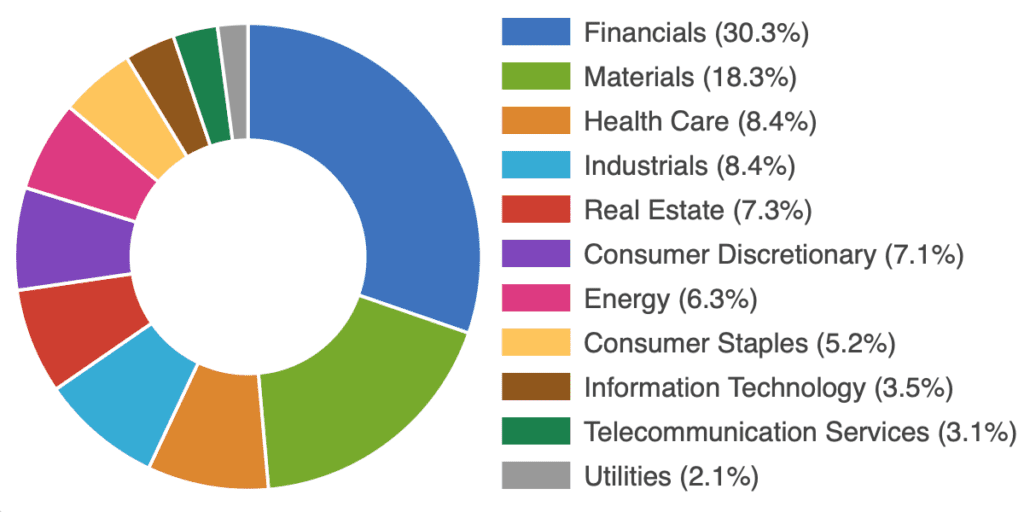

- The ASX represents just 2.1% of the world’s listed companies; is heavily weighted to mining, energy, financial services and healthcare; and is dominated by a handful of companies

Source: ASX Top 200 Companies – Breakdown of Industries and Sectors

What this means in combination is by only looking domestically, you may be limiting your investment opportunities.

By expanding your view and looking overseas, you can take advantage of international stock exchanges with much greater levels of diversification.

No other global securities exchange lacks diversification like the ASX

Ten companies make up approximately half of the value of the S&P/ASX 200 Index, which is our main index comprised of the 200 largest, listed Australian companies. This concentration has only increased since the BHP dual listing on the London Stock Exchange (LSE) was unwound in January 2022 and the LSE:BHP shares returned to ASX.

What this lack of diversification means for the ASX is more reliance on particular industries (such as mining and banking), and so greater volatility. For example, BHP and Rio Tinto (both in the top 10 of the S&P/ASX 200 Index) are heavily reliant on China’s demand for iron ore. If China softens, the S&P/ASX 200 Index suffers.

A concentrated market means the lion’s share of performance is attributed to very large companies, which may limit stock diversification for the average investor.

With greater populations come greater numbers of opportunities

Do you ever wonder why certain US or European products are not available in Australia? It is likely because those companies do not regard Australia’s relatively small population as ‘worth it’. To put it in perspective, the USA has about 332m people, or nearly 13 times the size of Australia’s 25.7m. California alone has a population of 39.2m!

With larger markets comes the greater likelihood of execution of innovation. There is a logical reason the likes of Microsoft, Google, Amazon, Facebook and Tesla are US companies – the significant population of the US allows for a huge market to test products, as well as excellent tertiary education institutions, sources of capital, an entrepreneur friendly economy and a highly skilled work force.

Australia’s Atlassian is an outlier in the tech landscape here – a globally dominant software company despite its Australian heritage. Although its headquarters are in Sydney, the company decided in 2015 to bypass the ASX and list directly on the NASDAQ, an American stock exchange based in New York City. This was due to the belief at the time that the size and maturity of the markets in the US offered it advantages over the ASX.

Government policy-based asset allocation

Another reason to look overseas is because of a desire to invest in companies with particular emphasis on environmental and sustainable policies. Such companies may not be available in Australia, due to the relatively less progressive environmental policies of Australia compared to some overseas countries.

To wrap up

None of this is saying the ASX should be ignored. Rather, by placing the ASX in a global context, it may help you better understand your investment options around the world.

For these reasons, Itrust Invest offers investors access to the Magellan Global Fund which comprises 20 – 40 of the biggest companies in the world including Microsoft, Google, Mastercard and Pepsico. Since its launch in July 2007, as at 28 February 2022 the Magellan Global Fund has returned 11.06% pa.

Source: Magellan Group | The Global Equities Fund

When it comes to investing the sooner you start, the more time compounding growth has to work it’s magic. Consider joining the Itrust Invest community today and start to make a real difference to the future of your loved ones.

If you’d like to know more then speak to the team via the live chat below, or give us a call on 1300 811 119 – we’d love to hear from you.

Copyright © Itrust Invest 2022

Disclaimer: in preparing this blog we have not considered your personal investment objectives, financial situation or needs. Instead, this blog contains general advice and has been prepared for informational purposes only. It is not intended as financial product advice or a recommendation in relation to any investments or securities. Terms apply when using the platform provided by Itrust Investment Fund, and it is important you read the PDS and key documents before deciding if any of our offerings are right for you.