Wondering what the best way to invest $1000 for a child is? Often times parents, relatives and guardians are keen to save and invest on behalf of their children due to the potential for better returns. Put simply, equity markets generally offer higher returns (capital growth plus dividend income) over the long term, relative to the interest rates earned in cash savings accounts.

But knowing the best way to invest for a child is a difficult question. Ultimately, it boils down to two important factors; what are your financial goals, and how much time do you have?

“Will this $1000 be put towards next year’s family holiday, or helping your child get into the property market in 20 years’ time?”

Depending on your timeline it may be necessary to shift your mindset away from piggy banks and savings accounts, as families have a lot to benefit by investing in share markets.

Now, for the benefit of our readers, Australian law generally prevents children under the age of 18 from making investments in their own name. However, an increasing number of Aussie parents and relatives are opening investment accounts in their own name and nominating their children as beneficiaries to that account.

With that in mind, let’s begin!

Australian shares

It’s no secret that investing in publicly listed Australian companies generally provides investors with superior returns to interest earned from cash over the long run.

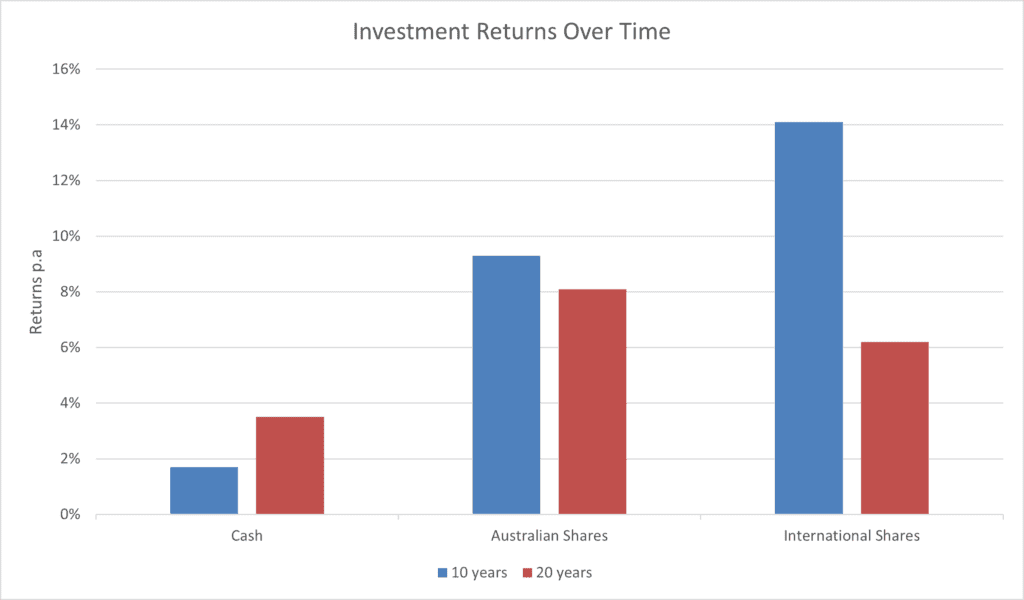

To illustrate this further, let’s look at the compounded returns of the ASX200 Accumulation Index (ASX: XJOAI). This index tracks the growth of the largest 200 companies listed on the Australian Stock Exchange (ASX) with all dividends being reinvested:

- From June 2002 to June 2022 there was a compounded annual growth rate of approximately 8.1% per annum (ASX: XJOAI). So, a $1,000 investment 20 years ago left untouched will have grown to $4,750*

Compared to the average 20-year returns on Australian cash being 3.5% p.a.**, this represents a premium of $2,721 just by investing in the Australian stock market instead of a bank account.

However, it’s important that you don’t ‘put all your eggs in the one basket’ and invest everything into a single stock or limit yourself to just one sector of the market. Capital loss is always a risk of investing, and without proper diversification, parents and relatives may expose themselves to large swings in the value of their investments.

Where To Invest $1000 in Australian Shares

While 5-7-years is generally enough time to ride out this volatility, it may be a better idea to consider an ETF that covers a wide range of the market, such as the SPDR S&P/ASX 200 ETF (ASX: STW). This ETF is a popular option for beginners as it grants investors low-cost access to the returns that correspond from the largest 200 companies listed in Australia, as represented in the S&P/ASX 200 Index, net of any fees, expenses, and tax.

International shares

The Australian share market is a great place for parents to invest $1,000 for children, but all things considered, there may be greater investment opportunities located offshore.

To put things into perspective, consider this;

- Australia comprises approximately 0.3% of the world’s population

- The ASX represents just 2.1% of the world’s listed companies

- Mining, energy, financial services and healthcare dominate the ASX, with 10 companies making up approximately half the value of the S&P/ASX200

“By expanding your view and looking overseas, you can take advantage of international stock exchanges with much greater levels of diversification.”

Another reason why parents might choose to invest in large, global companies is to help educate their kids on investing. It might be easier to explain to a young child how, thanks to purchasing shares, they are technically a part owner of their favourite brands, such as Disney or Apple.

So, if your goal is to not only earn a return over the long run but to educate your kids on the importance of investing, then international shares should be considered as the best way to invest $1000 for a child.

*Investment return data provided by Morningstar. Australian Shares – S&P/ASX 200 TR. International Shares – MSCI World Ex Australia NR AUD. Cash – RBA Bank accepted Bills 90 Days

Where To Invest $1000 in International Shares

For parents seeking exposure to the long-term growth potential of global companies then the Magellan Global Fund might be suitable. This actively managed fund is suited for investors with a 7–10-year investment horizon and comprises some of the biggest companies in the world including Microsoft, Google, Starbucks and Pepsico.

Since its launch in July 2007 the Magellan Global Fund has returned 10.2% per annum up to 31 August 2022.

Cash

Now I know what you’re thinking. Doesn’t this contradict saying piggy banks and savings accounts aren’t the best bang for your buck?

Well, if your financial goals are short term in nature (i.e., less than 3 years) then chances are you’re better off sticking with cash to avoid the volatility that comes with investing.

“Volatility is an investment term that describes the constantly changing and sometimes unpredictable nature of markets and is inherent at any level of investing.”

Cash as an investment option generally rewards investors with low (or no) return in exchange for taking on very little (or no) risk. While not the most exciting option, parents and guardians with a short-term goal might appreciate the certainty that $1000 will still be worth $1000 in less than three years’ time.

And saving money in the bank might still be the best way to invest $1000 for a child – particularly if the money will be put towards activities that foster development from a young age such as tutors, sports and family holidays.

But beware! Unless the returns from interest payments keep pace with inflation, the purchasing power of your savings may erode over time. For more info on inflation checkout our blog on the time value of money.

Wrapping up

Before deciding the best way to invest $1000 for a child it is important to understand what your short- and long-term financial goals are. Is this money going towards a new mountain bike at Christmas, or will you help your child get into the property market when they’re old enough?

As a rule of thumb, the shorter the timeline, the less risk (and therefore less growth) you are generally willing to accept, so saving cash might be more suitable. Conversely, the longer the timeline, the higher the risk (and therefore greater growth) you might be open to.

If you’re thinking of opening an investment account for your kids, then speak to one of our friendly experts via live chat or contact us on 1300 811 119.

Copyright © Itrust Invest 2022

Disclaimer: in preparing this blog we have not considered your personal investment objectives, financial situation or needs. Instead, this blog contains general advice and has been prepared for informational purposes only. It is not intended as financial product advice or a recommendation in relation to any investments or securities. Terms apply when using the platform provided by Itrust Investment Fund, and it is important you read the PDS and key documents before deciding if any of our offerings are right for you.

*Net of fees, taxes and investment costs. Past performance is not a reliable indicator of future performance.

**RBA Bank accepted Bills 90 Days

***MSCI World Ex Australia NR AUD